Employer retention credit calculation

To oversimplify the calculation your business could be eligible for up to 5000 per employee for 2020 and up to 28000 per employee in 2021. Increased the maximum per employee to 7000 per employee per quarter in 2021.

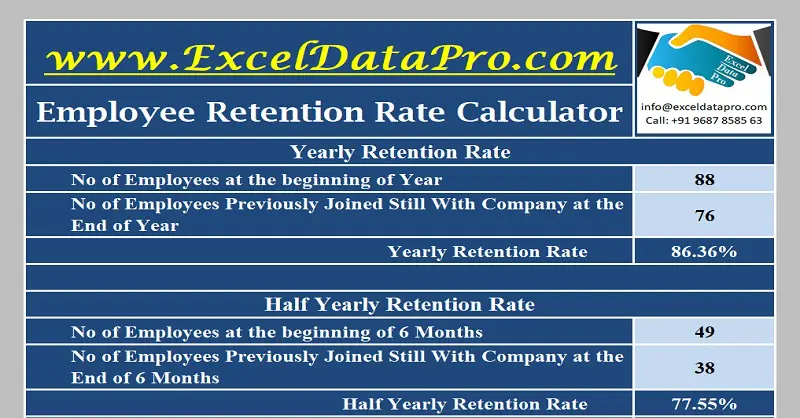

Download Employee Retention Rate Calculator Excel Template Exceldatapro

The employee retention credit is a credit created to encourage employers to keep their employees on the payroll.

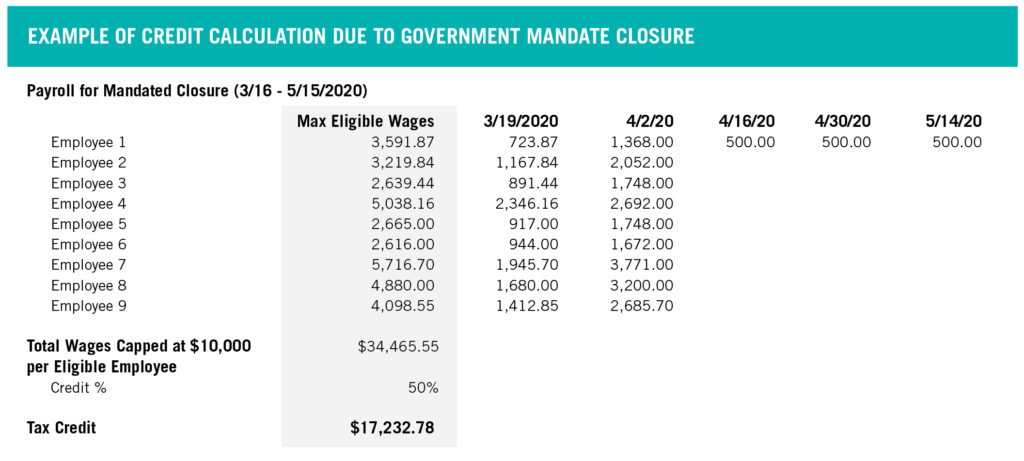

. Employee Retention Tax Credit Estimate Calculator The Employee Retention Tax Credit ERTC was created as part of the CARES Act to encourage businesses to continue paying employees. Lets look at an example. These include wages and compensation subject to FICA taxes and qualified health.

Calculate your Tax Credit Amount. Thus the maximum employee retention credit available is 7000 per employee per calendar quarter for a total of 14000 for the first two calendar quarters of 2021. Qualified employers can claim up to 50 of their employees.

EY Employee Retention Credit Calculator. The ERC calculation requires a quarterly comparison of your business revenue. Use our simple calculator to see if you qualify for the ERC and if so by how much.

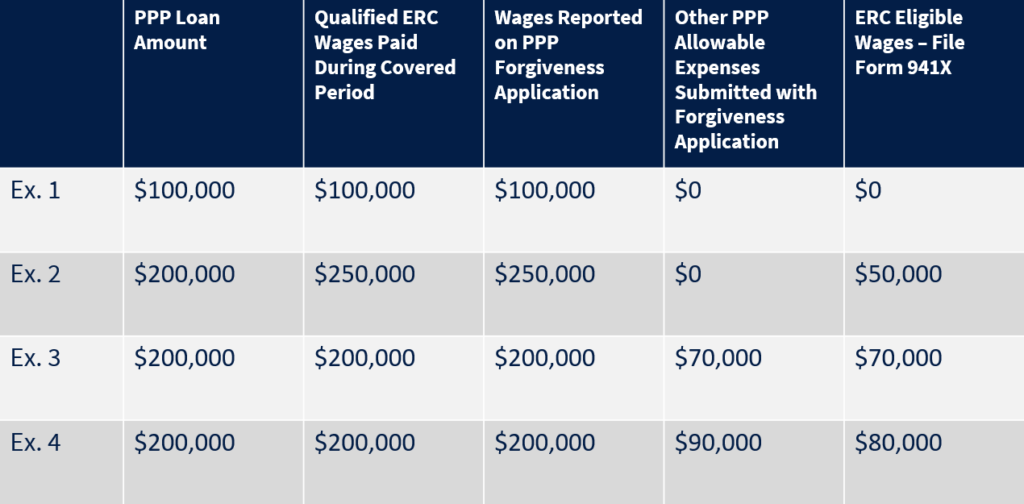

For each 2021 quarter an eligible employer can credit up to 10000 in qualified wages per employee. Employers who qualify including PPP recipients can claim a credit against 70 of qualified wages paid. Additionally the amount of wages that qualifies for the credit is now.

For the 2020 refund you must show gross receipts proving a significant decline in revenue of 50. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19. The ERC calculation is based on total qualified wages including health plan expenses paid by the employer to the employee.

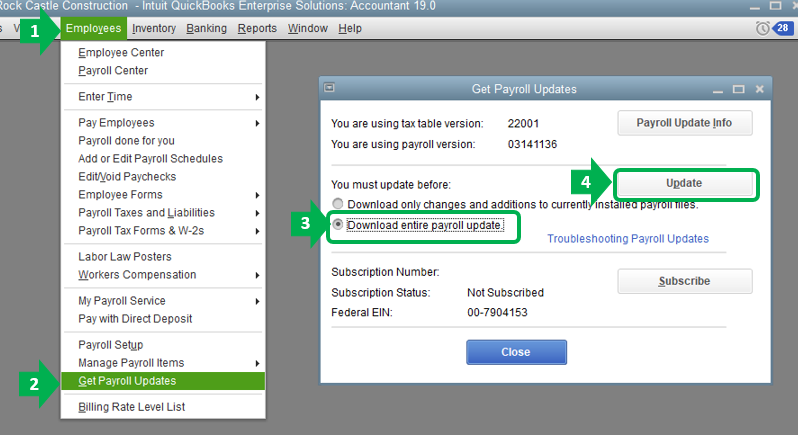

The ERC Calculator will ask questions about the companys gross receipts and employee counts in. To receive the Employee Retention Credit ERC you first need to compute the total qualified wages and then the related health insurance expenditures for each quarter and. Maintained quarterly maximum defined.

For employers with fewer than 500 full time employees in 2019 all wages paid to. The ERC equals 50 percent of the qualified. If youre going off of 2020 wages your ERC is 50 of the qualified wages discussed aboveyou can get a maximum ERC of 5000 per employee per.

There are many things that qualify when you calculate your Employee Retention Tax Credit. Maximum credit of 5000 per employee in 2020. The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act.

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Answers To Employee Retention Credit Faqs Lendio

Employee Retention Credit Spreadsheet Youtube

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Changes To The Employee Retention Credit Erc

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Employee Retention Credit Irs Updates Guidance On Ppp Coordination Issues And More Sc H Group

2

2

Employee Retention Credit Worksheet 1

2

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Erc Calculator Gusto

A Guide To Understand Employee Retention Credit Calculation Spreadsheet 2021 Disasterloanadvisors Com

Employee Retention Credit Erc Calculator Gusto

2

Covid 19 Relief Legislation Expands Employee Retention Credit Insights Ksm Katz Sapper Miller